And with anything as important as your credit, you want to make sure it is in the best shape as possible. And one of the best ways to have it in shape is to not fall victim to some common myths and misconceptions that have been floating around out here.

And with anything as important as your credit, you want to make sure it is in the best shape as possible. And one of the best ways to have it in shape is to not fall victim to some common myths and misconceptions that have been floating around out here.

As someone who admits to be being semi-obsessed with my own credit, I’m always looking for techniques or strategies that will give me a boost or help maintain my credit in the “very good” to “excellent” range.

When it comes to credit, there are three companies that you have to be aware of. Equifax, Experian, and TransUnion are the Big Three credit reporting agencies that are used by almost all lenders in this country. If you’re looking to get a loan to buy a house, a car, or any other major asset; chances are one of these agencies (if not all three) will play a huge role in whether you get approved or not. So if you have not already; you’ll want to get very familiar with these three because they will play a factor in some of the biggest purchases you’ll make in your life.

With that said; whether you’re looking to maintain excellent/good credit, looking to rebuild your credit, or you’re just like me and you’re a credit nerd, here are some good things to be aware of that may help (or hurt) you.

You inherit your spouse’s credit

I want to start off by immediately addressing one of the biggest myths out there when it comes to credit. Most of us have been told that once you get married you automatically merge with your spouse’s credit history, whether they have an excellent credit history or an atrocious credit history. Let me tell you that is not true.

Each of you will continue to have your own separate credit histories. Your credit is tied to your Social Security number, and since your Social Security number does not change or get combined when you get married, your credit will be unaffected by marriage.

HOWEVER, your spouse’s credit history will definitely come into play once you both apply for a joint loan or open a joint account. The most common example of this is when y ou both are looking to buy a house together. Lenders will take a look at both of your credit scores and history to determine whether you would qualify for a loan. So it is important that you both have satisfactory credit to get approved, or not have a very high interest rate.

ou both are looking to buy a house together. Lenders will take a look at both of your credit scores and history to determine whether you would qualify for a loan. So it is important that you both have satisfactory credit to get approved, or not have a very high interest rate.

In instances where one spouse may not have desirable credit, couples can opt to just have one spouse apply for the loan to have a better shot at getting approved. Keep in mind that in those cases you may not be able to use your spouse’s income to help get approved.

Late payments will be listed on your credit report

This is not totally a myth, however there needs to be some clarification with this. Late payments show up on your credit report if they are over 30 days late. So if you happen to make your car payment a day late, it won’t have a negative impact on your credit.

HOWEVER, that does not mean that you won’t be charged a late payment fee or have some other action taken by the lender. So it is highly recommended that you pay your bills on time to avoid any type of potential negative impact on your credit or any type of additional fees.

Dispute, Dispute, Dispute

We’re going to start addressing instances where you might have some derogatory items on your credit such as collection accounts. If you do have a collection account that shows up, first thing you should always do is dispute it.

Now we won’t get into the moral aspect of disputing a collection on your credit that you know damn well is yours, but taking advantage of loopholes is as American as apple pie. When it comes to collections, the onus is not on you to prove that the collection is not yours; the onus is on the collection company to prove that the collection is yours. And they have to do so within 30 days of you filing a dispute.

T ruth of the matter is that once an account has been sold to a collection company, they may or may not have all the required legal documents to prove a debt belongs to you. In cases where they don’t have the documentation to prove that a debt is yours within 30 days, the collection is required to be removed off your credit report.

ruth of the matter is that once an account has been sold to a collection company, they may or may not have all the required legal documents to prove a debt belongs to you. In cases where they don’t have the documentation to prove that a debt is yours within 30 days, the collection is required to be removed off your credit report.

It’s a swing for the fences, but you’ll be surprised how easily you can get an item removed just by disputing it.

Don’t ever pay the collection company

If after you dispute the item it is verified as being yours, at this point you can opt to pay off the debt. Here’s the thing, don’t ever pay the collection company. Instead, pay the original company that the debt was incurred if possible.

For example, say you owed Verizon $100 and it was never paid. Verizon eventually turns that debt over to a collection agency. When you want to pay off the $100, bypass the collection agency and call Verizon directly. Most companies will still have record of the debt and would be willing to take payment from you to resolve the debt.

Once the debt is paid, ask for some sort of documentation confirming nothing is owed and ask them to notify the collection company that the debt has been resolved. There are two reasons why we say to do this…

Paying a collection off does not automatically remove it

A lot of people think that once you pay off a collection that it will come off your credit report. Nope, that is not true. Collections will remain on your credit report for up to seven years. Your credit will still feel the negative impact of the collection.

Dispute a collection after it has been paid

One way to possibly remove the collection showing up on your report is to follow our advice and pay the original company directly. Once that has been done, then you want to go ahead and dispute the collection.

In most cases the collection agency will be notified by the original company that the debt has been paid; later on when your dispute comes in and they have to prove that the debt belongs to you, they’ll have little to no incentive to do so and they may not even respond at all. Next thing you know, the collection is gone from your credit report 30 days later.

Now we want to be clear, this method DOES NOT always work. After all this the collection could still remain on your credit report. If that’s the case you can opt to write a letter asking the collection agency to remove it and furnish proof that you paid the debt; but it is totally up to that agency if they’ll agree to do so.

FICO vs. VantageScores

As you may already know, our credit history is given a score. Similar to a score or grade we all got in High School or College, your credit score will generally fall in between the ranges of 300-850. The higher your score, the better. So a person with a 580 credit score will have a much harder time getting approved for loans than a person with a 720 score.

Your credit score generally will be computed under two models; FICO and VantageScores. FICO (Fair, Isaac and Company) was founded in 1956 by William Fair and Earl Isaac. FICO is widely considered to be the most used credit scoring model by lenders in this country. Anytime you’re applying for a loan, it is safe to say your FICO score will be used to determine if you’ll be approved or not.

The VantageScore was created in 2006 by the three major credit reporting agencies (Equifax, Experian, and TransUnion) to also be used by lenders.

While FICO is still the king of credit scoring systems, it does not hurt to frequently check both scores from time to time. I always check my FICO score on their website (www.myfico.com), which is a great tool to monitor your scores. There is a cost however to check your FICO score ($60 to see scores from all three agencies). As far as your VantageScore, you could view that for free by signing up on certain websites like www.creditkarma.com or www.lendingtree.com.

While FICO is still the king of credit scoring systems, it does not hurt to frequently check both scores from time to time. I always check my FICO score on their website (www.myfico.com), which is a great tool to monitor your scores. There is a cost however to check your FICO score ($60 to see scores from all three agencies). As far as your VantageScore, you could view that for free by signing up on certain websites like www.creditkarma.com or www.lendingtree.com.

You have multiple FICO scores

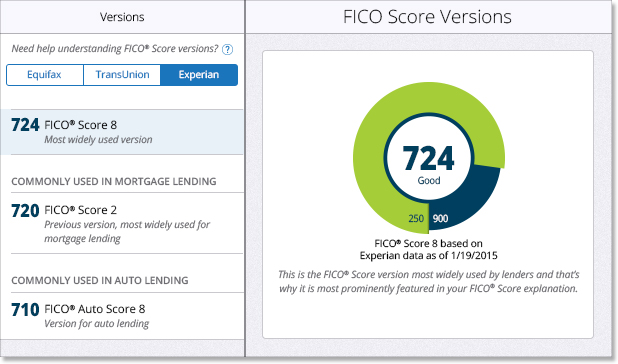

Just when you thought you only had to keep up with one FICO score from each credit reporting agency, you’ll actually have to keep up with multiple FICO scores from each agency. FICO has different versions of their score; there’s a version that mortgage lenders use, a version that auto lenders use, a version that credit card lenders use, etc.

So for example you can have a FICO score of 752 with the version mortgage lenders use, but your score can be 773 with the version auto lenders use. The explanation for why the scores differ between versions is very complex and I won’t mislead you to think that I can properly articulate it; just know that different scores exist.

If you’re about to make a big purchase like a house or car, get very familiar with the score you have for that particular purchase.

Multiple credit pulls don’t always hurt

Multiple credit pulls don’t always hurt

Another popular myth that has been floating around is that having your credit pulled multiple times will drop your score with each inquiry. That is not always the case.

When you’re shopping for a car or home, it’s wise to compare rates with multiple lenders to see who would give you the best arrangement for your budget. In order to compare rates, your credit is going to have to be pulled by each lender.

Lucky for us as the consumer, credit pulls/inquiries made within a 30 day period will be counted as one. So for example if you’re car shopping and you have your credit pulled by the dealership, your bank, or another 3rd party lender all within 30 days of each other; your credit score will only be affected as having one inquiry instead of three.

So feel free to do your due diligence and compare rates from multiple lenders. Last time I went car shopping, I compared rates from over five different lenders before choosing one and my credit score only took the hit of one inquiry.

Paying off your credit cards is not always good

Paying off your credit cards is not always good

Now this to me happens to be one of the most ludicrous things when it comes to managing your credit scores. I usually made it a habit to always try to pay off my credit card balances each month to avoid paying interest. I started to notice that whenever I did that, either my credit score was unaffected or it even dropped a few points. It drove me crazy because I thought that my scores should go up if I don’t carry a balance (remember, I’m semi-obsessed about my credit).

When managing your credit, you’ll want to be familiar with your credit utilization rate or ratio. Simply put, your credit utilization ratio is how much you currently owe divided by your credit limit.

For example, let’s say you have a credit card with a $1,000 credit limit. Your balance that you have on your credit card is $400; your credit utilization is at 40% ($400 balance/$1,000 credit limit). Now let’s say you have three credit cards and the combined credit limit for all of them is $10,000. If your total balance on all three is $6,000, your credit utilization is 60%.

To lenders if you have a high credit utilization rate, you are considered high risk. And rightfully so; if you’re maxing out your credit cards that is a serious cause for concern. The general rule of thumb is that you ideally would like to have a credit utilization of 30% or less.

But here’s the kicker, having a credit utilization of 0% is not the best for your score. Yes you read that correctly, carrying no balances on your credit cards month to month can actually hurt you a little bit.

As ironic as it sounds, having no balances on your credit card(s) for extended periods of time is giving the perception that you don’t use credit at all. And the credit scoring modules used by the three agencies will ding you for that. You’ll see varying opinions on what is the absolute best utilization rate to have, but if you’re between 1%-10% then you’ll be in a very good spot.

Hopefully this information you find helpful and I strongly encourage you to check your credit report several times a year. Also, take advantage of your right to receive one free credit report a year at www.annualcreditreport.com. Good luck!